Steel industry players say retaliatory tariffs for Canadian steel need ‘real teeth’ as lobbying efforts heat up

With the U.S. effectively cut off from Canadian steel because of a high tariff, Algoma Steel’s message to Ottawa is that much stronger measures will be needed to help the ailing industry pivot to the domestic market over the long term if a trade deal cannot be reached.

“If the U.S. market is closed off to Canadian steel-makers with a 50 or 25-per-cent tariff, we have to have competitive access to the Canadian market, and right now we just don’t have it with the amount of foreign steel that’s being dumped and traded into Canada,” said Mike Garcia, CEO of Algoma Steel. “If a trade agreement isn’t forthcoming, then … we’re advocating very strongly for [the federal government] to put real teeth behind the retaliatory tariffs.”

U.S. tariffs on all imports of aluminum and steel have stood at 50 per cent since June 4, when they increased from the previous levy of 25 per cent. The 50-per-cent tariff rate renders the U.S. market, which historically makes up about half of Algoma Steel’s sales “pretty much inaccessible for the Canadian steel industry,” said Garcia.

During the trade war, Garcia said Algoma’s advocacy has focused on the importance of the free trade of steel between the U.S. and Canada, and the argument that the steel industry is strategically important to both countries. However, if the U.S. tariffs remain in place, Algoma is pushing the message that Canada needs to work very quickly and aggressively to create an environment where the domestic steel industry can become the majority supplier of the steel sold in Canada, according to Garcia.

“We advocate for very strong anti-dumping measures, for [tariff-rate quotas] on foreign steel. We advocate for very strong buy-Canadian preferences in infrastructure projects and any defence project. That’s the type of advocacy we’re having with the government, as well as just helping them understand the urgency of the situation,” he said.

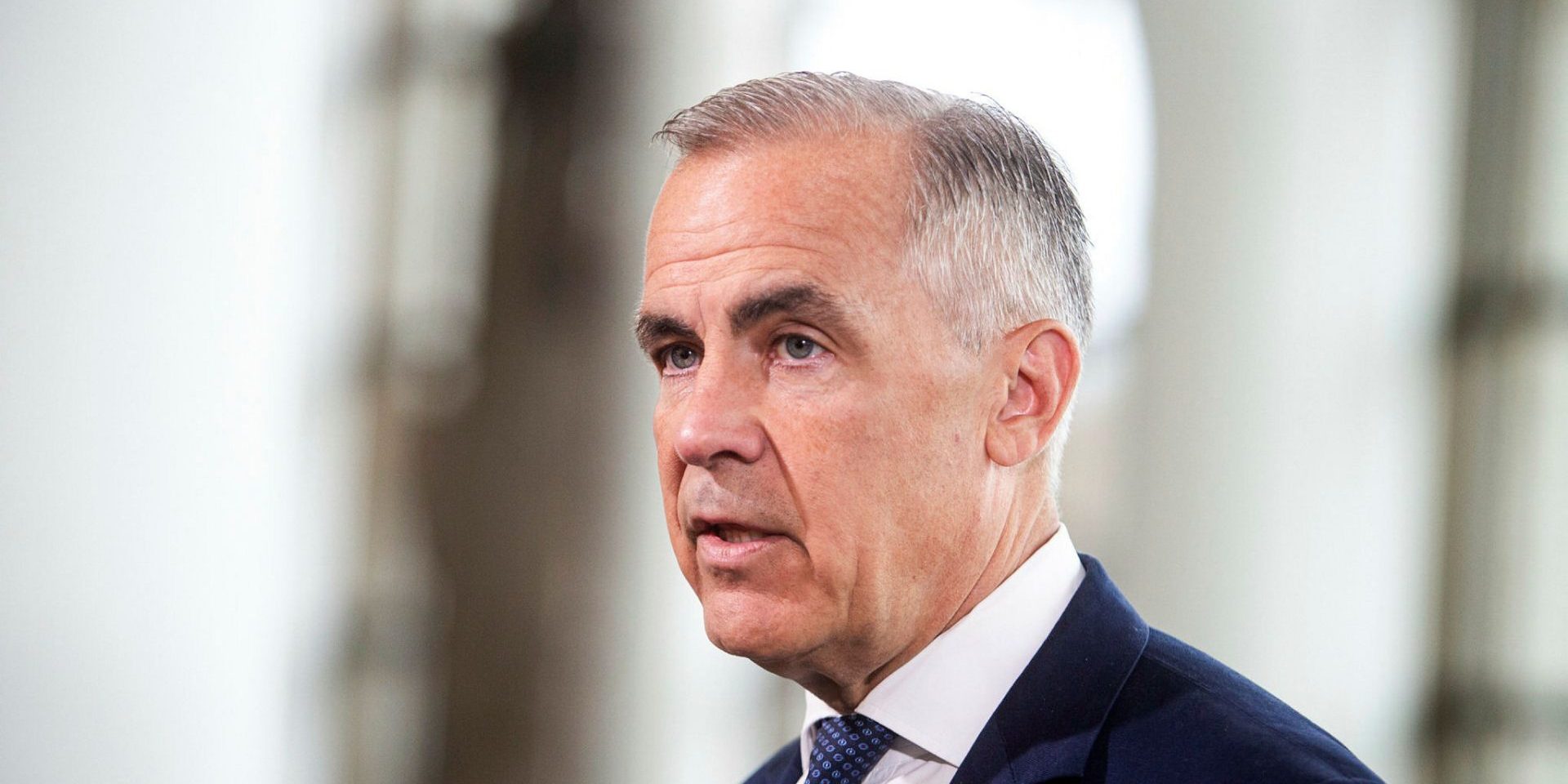

Prime Minister Mark Carney (Nepean, Ont.) announced a number of measures on July 16 intended to help Canada’s steel industry. Among those, Carney announced that Canada will tighten the tariff-rate quota levels—as in the level of imports that can be brought into Canada at a lower duty rate—for steel products from non-free trade agreement countries from 100 per cent to 50 per cent of 2024 volumes. Above those levels, a 50-per-cent tariff will apply.

Carney also announced that, for non-U.S. partners with whom Canada has a free trade agreement, a tariff-rate quota level for steel products at 100 per cent of 2024 volumes will be introduced, along with a 50-per-cent tariff on steel imports above those levels.

Garcia called this a good start that shows the federal government is taking the steel industry seriously, but also called these measures insufficient.

“You shouldn’t grant blanket exceptions for a steel company to buy U.S. steel if that steel is available in the Canadian market,” said Garcia. “If it’s [a] product that is made by the domestic Canadian steel industry, then our argument is that it should have a retaliatory tariff with no exceptions at all. That would give the Canadian steel industry a real chance … to be the supplier for all this steel that’s consumed in Canada. Right now, we’re competing against so many foreign steel producers, including the U.S. steel producers that are able to ship their steel into Canada.”

On July 24, Algoma announced it has applied for a $500-million loan from the federal government because of concerns about the “significant impact” of the U.S.’ current 50-per-cent tariffs. In a press release, Algoma stated the company has sufficient resources to manage its liquidity over the near term, but ongoing uncertainty caused by the U.S. tariffs is resulting in a “structural imbalance in the Canadian market,” which is leaving the company to consider various alternatives.

Algoma, an independent, publicly-traded steel producer based in Sault Ste. Marie, Ont., applied for the loan under the Large Enterprise Tariff Loan program announced by Ottawa in March to support Canadian companies affected by tariffs and countermeasures.

“Algoma anticipates that such support would be used to support the company’s continuing operations while exploring diversification of the company’s customer base to facilitate long-term competitiveness. The amount of additional financing that Algoma will seek will depend, in part, on the duration and severity of the trade dispute and the extent to which the Canadian steel market remains exposed to unfairly priced imports,” reads the press release.

The Hill Times reached out to the Canadian Steel Producers Association (CSPA) to ask about its advocacy with the federal government, but Eddie Hutchinson, CSPA’s manager of public affairs, responded in an email on July 22 that the CSPA would be unable to accommodate an interview.

In response to the measures announced by Carney on July 16, CSPA president and CEO Catherine Cobden said in a press release that same day that her organization welcomes the federal government’s support “as the consequences are devastating from the unjustified trade action” by the U.S.

“Reducing quota levels on non-free trade partners to 50 per cent of 2024 levels and imposing quotas on free trade partners at 2024 levels with a 50-per-cent over-quota tariff rate are steps in the right direction. We are grateful that the government has acted swiftly and taken this first response to improve these measures to support our industry in Canada and strengthen our domestic market,” said Cobden in the press release. “By also imposing 25-per-cent tariffs on steel products melted and poured in China, Canada is a global leader in taking real action to combat the fundamental and disruptive challenge of steel overcapacity.”

The CSPA filed 72 communication reports for lobbying activity between January and June in 2025, based on a search of the federal lobbyists’ registry on July 22. In that time frame, the majority of its lobbying activity was concentrated in June, with 30 reports filed, followed by February, with 15.

On June 27, the CSPA communicated with Carney, Industry Minister Mélanie Joly (Ahuntsic-Cartierville, Que.) Finance Minister François-Philippe Champagne (Saint-Maurice—Champlain, Que.), International Trade Minister Dominic LeBlanc (Beauséjour, N.B.), and Kirsten Hillman, ambassador of Canada to the U.S.

The previous day, the CSPA released a statement on their website, in which Cobden argued that the U.S. tariffs had resulted in “a significant blow” to Canada’s steel industry, and that measures announced by the federal government up to that point—while appreciated—failed to adequately address the crisis.

Last month, representatives of the CSPA also communicated on June 5 with Minister of Foreign Affairs Anita Anand (Oakville East, Ont.), Joly, Champagne and LeBlanc, as well as with Minister of Jobs and Families Patty Hajdu (Thunder Bay—Superior North, Ont.) on June 13.

Other federal government actions related to supporting the domestic steel industry include an announcement on June 19 by Champagne, who said the government would create two government-stakeholder task forces, one for steel and one for aluminum, to closely monitor trade and market trends.

Canada’s steel and aluminum task forces were jointly assembled in the days following the June announcement, and meet on a biweekly basis to support government decision-making with the primary objective of better supporting Canadian industry and workers, according to an emailed statement on July 23 to The Hill Times from John Fragos, press secretary in Champagne’s office.

“Their shared input helps inform decision-making and ensures that ongoing assessments of trade measures are informed by data and evidence—and are made without undue harm to the Canadian economy,” said Fragos in the statement. “The groups are comprised of dozens of representatives from the steel and aluminum industry associations and their members (including representation from all parts of the value chain), organized labour, the provinces and territories, and multiple government departments and agencies. Industry and union representatives were responsible for identifying their respective participants for the task force.”

Rita Rahmati, director of communications and public affairs for the Canadian Institute of Steel Construction (CISC), told The Hill Times that the trade war is “very serious.” She noted that the current U.S. tariff on steel includes steel-derivative products, unlike the previous U.S. tariffs on steel in 2018.

She said in the past six months, the CISC has been engaging with federal government officials on almost a weekly basis. Her organization’s message to the federal government is for a “strategic approach” in response to the tariff. As an example, she pointed out that wide flange beams, which are commonly used for structural support in construction projects, are not produced in Canada at all.

“There’s zero domestic capabilities for that product specifically, and we’re very largely reliant upon the U.S. for imports of that product. So, we’ve been echoing to the government that, while we’re supportive of putting retaliatory tariffs on the U.S., it has to be done strategically. It can’t just be a one-for-one, because our domestic capabilities are not the same as the U.S., as that will disproportionately impact us in Canada,” she said. “Another important advocacy point for us has been, while we’re essentially now being cut off from the U.S. market … we need to make sure that government taxpayer dollars for infrastructure projects are going to support Canadian steel fabricators and producers, so that we’re able to have work in Canada while we’re cut off from the U.S. market.”

Rahmati said that a major concern is the uncertainty of how long the tariffs will persist.

“The impacts right now are one thing, but the longer this goes on, the less there’s confidence in being able to supply steel and build with steel,” she said. “That means contracted projects being lost down the line, and we can see those impacts one year from now, two years from now, [or] three years from now. Infrastructure projects are not projects that are built in just a few months.”

Canada’s Top 10 Trading Partners (May 2025)

| Country | Total exports ($) |

| United States | $43,930,628,827 |

| United Kingdom | $5,222,741,473 |

| China | $2,358,731,393 |

| Japan | $1,297,737,027 |

| Netherlands | $830,138,730 |

| Mexico | $671,451,207 |

| Germany | $629,624,714 |

| Korea, South | $615,587,995 |

| Singapore | $419,612,340 |

| Indonesia | $402,690,407 |

The above table shows Canada’s top trading partners in May 2025. Information courtesy of Statistics Canada

Canada Trade Statistics (May, 2025)

- In May 2025, Canada exported $58.5-billion and imported $65.7-billion, resulting in a negative trade balance of $7.24-billion.

- The top exports from Canada were crude petroleum ($11.1-billion), gold ($5.23-billion), cars ($3.29-billion), motor vehicle parts and accessories ($1.4-billion), and petroleum gas ($1.26-billion).

- In May 2025, the exports of Canada were mainly from Ontario ($22.6-billion), Alberta ($13.8-billion), Quebec ($8.96-billion), British Columbia ($4.42-billion), and Saskatchewan ($3.49-billion), while imports destinations were mainly Ontario ($40.2-billion), Quebec ($9.49-billion), and British Columbia ($6.28-billion).

- Canada exported mostly to the United States ($40.5-billion), United Kingdom ($5.17-billion), China ($2.3-billion), Japan ($1.27-billion), and the Netherlands ($780-million), and imported mostly from the United States ($28.7-billion), China ($8.38-billion), Mexico ($4.24-billion), Germany ($1.86-billion), and Vietnam ($1.72-billion).

Source: The Observatory of Economic Complexity (OEC)

LICENSING

LICENSING PODCAST

PODCAST ALERTS

ALERTS