Senators praise PBO report to release ‘crucial’ public accounts earlier, but government reluctant to commit to changes

The parliamentary budget officer’s proposal calling for Ottawa’s year-end financial reports to be released on an earlier timeline is drawing praise from parliamentarians, but the government isn’t yet willing to commit to the advice.

On Sept. 13, the Parliamentary Budget Office (PBO) released a report that said the federal government should align itself with financial reporting practices preferred by the International Monetary Fund, and publish its annual financial statements within six months of the end of the fiscal year. That would mean changing the Dec. 31 deadline to a Sept. 30 cut-off, six months after Ottawa’s fiscal year ends on March 31.

This year-end report, known as the public accounts, is a key document that shows what money the government actually collected and spent in a fiscal year. However, it tends to receive far less attention than the budget which comes near the beginning of the fiscal year, and lays out a blueprint of projected revenues and spending.

In an interview with The Hill Times, Parliamentary Budget Officer Yves Giroux said releasing the public accounts earlier would provide parliamentarians with vital information when they are making decisions about the current fiscal year.

As The Hill Times reported in a three-part feature series this spring, many former parliamentarians and public finance experts say the overall federal fiscal cycle happens on a flawed timeline, and is too opaque to promote proper scrutiny of government spending.

While there’s “no perfect system,” said Giroux, “every bit would help,” and this proposed change is one step that would improve the overall cycle of budgets, estimates, and accounts.

In particular, a Sept. 30 deadline for public accounts would ensure parliamentarians have the bottom line from the last fiscal year when assessing two key documents for the current one: the fall economic statement in which the government updates its fiscal blueprint; and the second set of annual supplementary estimates through which the government formally requests Parliament’s approval to spend billions of dollars.

“Year after year, parliamentarians are asked to vote on appropriations when they don’t know what really happened for the previous year,” said Giroux.

Info that’s ‘almost ready for the archives’: Sen. Marshall

Conservative Senator Elizabeth Marshall (Newfoundland and Labrador), who is a member of the Senate Finance Committee and previously served as auditor general of her home province, called the report “excellent.”

She echoed Giroux’s diagnosis that the present timeline “leaves parliamentarians without crucial information to hold spending to account.”

“The information that we receive now is so old it’s almost ready for the archives,” said Marshall.

For example, when studying the fall estimates, it would be useful to know whether a department had spent its full budget in the previous year, said Marshall. If it hadn’t, this would support questioning of department officials at committee about why they are asking for that sum again.

She said it would also be valuable to know sooner whether the government stayed within its deficit target for the previous year, or blew past it.

CSG Senator Krista Ross (New Brunswick), another member of the Senate Finance Committee, said she also supports the recommendation.

Ross, who joined the Upper Chamber in November 2023, said, as a new Senator, “it would be really helpful to have things more quickly” and “in a different order.”

“We’re studying estimates, budgets, everything at the same time,” said Ross, making the case this impedes proper scrutiny. “They’re huge documents … it’s just simply a lot to cover in a very short time.”

CSG Senator Colin Deacon (Nova Scotia) said he supports the proposal because improving “legacy systems” is vital to maintaining trust in government.

“It is easier to do things faster today than we’ve ever done in the past, but government systems do not seem to adapt,” said Deacon. “If we don’t keep up with transparency standards, trust will diminish.”

‘Nothing to focus the mind like a deadline’: Giroux

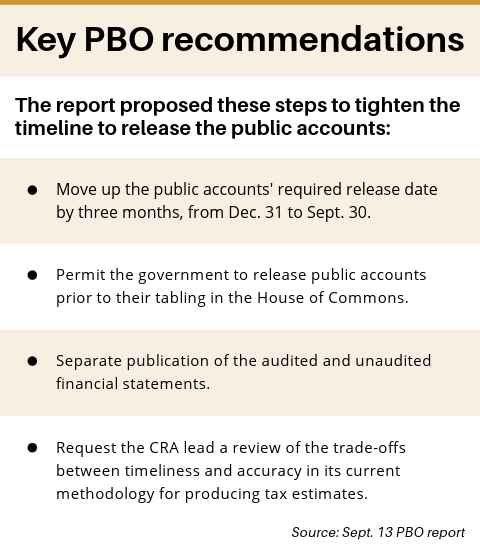

The PBO made several specific recommendations to achieve a quicker timeline.

Some involve saving valuable days near the end of the process, when the accounts are ready but the product is not yet out the door.

In the past 10 years, the accounts have generally received sign-off from the auditor general by early September, but it has taken another 22-to-74 business days to release them.

Some of this time goes into producing print, PDF, HTML, and Open Data formats in both official languages. The government says this requires 30 business days but on several occasions has taken fewer, meaning there may be efficiencies to move closer to a Sept. 30 target, says the PBO.

Some of the latest releases have happened in election years because the accounts can only be tabled when Parliament is sitting.

Removing this requirement would eliminate a further source of delay, says the report.

It would also open the door to the accounts being released during an election campaign when there is the potential for them to receive greater public attention.

If these efficiencies are not enough, the PBO says the government could try to have the accounts themselves ready sooner.

It suggests asking the Canada Revenue Agency to provide tax revenue estimates earlier.

This would necessitate weighing trade-offs between timeliness and accuracy, but evidence from other jurisdictions shows “reliably estimating tax revenues can be done in a much timelier manner,” says the report.

CRA spokesperson Benoit Sabourin told The Hill Times in an email the agency is “open to collaborating” with other departments and the PBO on this matter. Sabourin added that “timeliness and accuracy must be balanced” because taxes are “the most significant source of revenues” in the financial statements.

The PBO also suggests some aspects of the public accounts could be released earlier by separating audited and unaudited statements.

In an email to The Hill Times, a spokesperson for the auditor general said their office is “supportive of any effort by the government to have the public accounts released in a timely manner while ensuring that the information is accurate.”

Their reply did not specifically address the PBO recommendation about separating audited and unaudited financial statements.

Finally, the PBO recommends the government amend the Financial Administration Act so Ottawa is legally required to release the accounts by Sept. 30.

“Nothing to focus the mind like a deadline,” said Giroux.

PBO proposals should be in party platforms: Page

Former PBO Kevin Page, who now leads the Institute of Fiscal Studies and Democracy at the University of Ottawa, said he supports the analysis, and called on the federal political parties to take action.

“Canada’s federal political parties should consider the PBO recommendations as possibilities for inclusion in their election platforms to strengthen fiscal accountability,” said Page.

However, members of the House Public Accounts Committee stopped short of a full endorsement.

Conservative MP John Williamson (New Brunswick Southwest, N.B.), who serves as the committee’s chair, said in an email, “I agree with the PBO report, as does the Public Accounts Committee.”

However, the committee favours an Oct. 15 deadline, not Sept. 30.

Williams pointed to the committee’s studies of the 2020-21 and 2021-22 public accounts which made that recommendation.

That’s two-and-a-half months earlier than the current deadline, but still half a month short of the PBO’s recommendation.

Liberal MP Jean Yip (Scarborough-Agincourt, Ont.), a vice-chair of the committee, left the door open to maintaining even more flexibility.

“The tabling date of the public accounts has been a recurring topic at committee,” said Yip in an email. “We understand the benefits outlined by the PBO but recognize the challenges in doing this, given that it is an incredibly large and complex document.”

The Bloc and NDP committee members did not reply.

Government won’t commit to legislating change

Public Services and Procurement Minister Jean-Yves Duclos (Québec, Que.) is receiver general of Canada, the central treasurer and accountant of the federal government. His department is responsible for the public accounts.

A spokesperson for Duclos declined to comment “as the report was published only a few days ago and the recommendations have implications in various departments.”

The Hill Times also reached out to the Treasury Board Secretariat. It has responsibility for the estimates, another key part of the fiscal cycle.

Martin Potvin, a Treasury Board spokesperson, said “the government is taking steps to streamline the process.”

Potvin said following the House Public Accounts Committee’s recommendations “the government committed to consultations to assess the feasibility of tabling the Public Accounts on or before October 15.”

Based this consultation, he said the government had notified the committee a “production plan is being adapted” to produce the accounts by Oct. 15 starting in 2025.

Potvin said this is “in line” with the PBO’s recommendation to “look for ways to advance the release.”

However, it falls half a month later than the PBO’s recommendation, and a new production plan is not the same as changing the legal deadline.

Potvin did not address questions regarding the PBO’s specific suggestions for speeding up the process.

Editor’s note: This story was updated on Sept. 23, 2024, to clarify the third recommendation from the PBO listed in the infographic. The PBO is calling for separate publication of audited and unaudited financial statements within the public accounts, with the audited consolidated financial statements published within six months of the fiscal year-end, and the supplementary information later.

icampbell@hilltimes.com

The Hill Times

LICENSING

LICENSING PODCAST

PODCAST ALERTS

ALERTS