Canada urgently needs a new growth strategy in response to Trump’s economic war

TORONTO—With his “Liberation Day,” United States President Donald Trump has declared economic war on the rest of the world—including Canada. We have retaliated, as we have to. But we must move beyond retaliation and negotiation to a new growth strategy for our country.

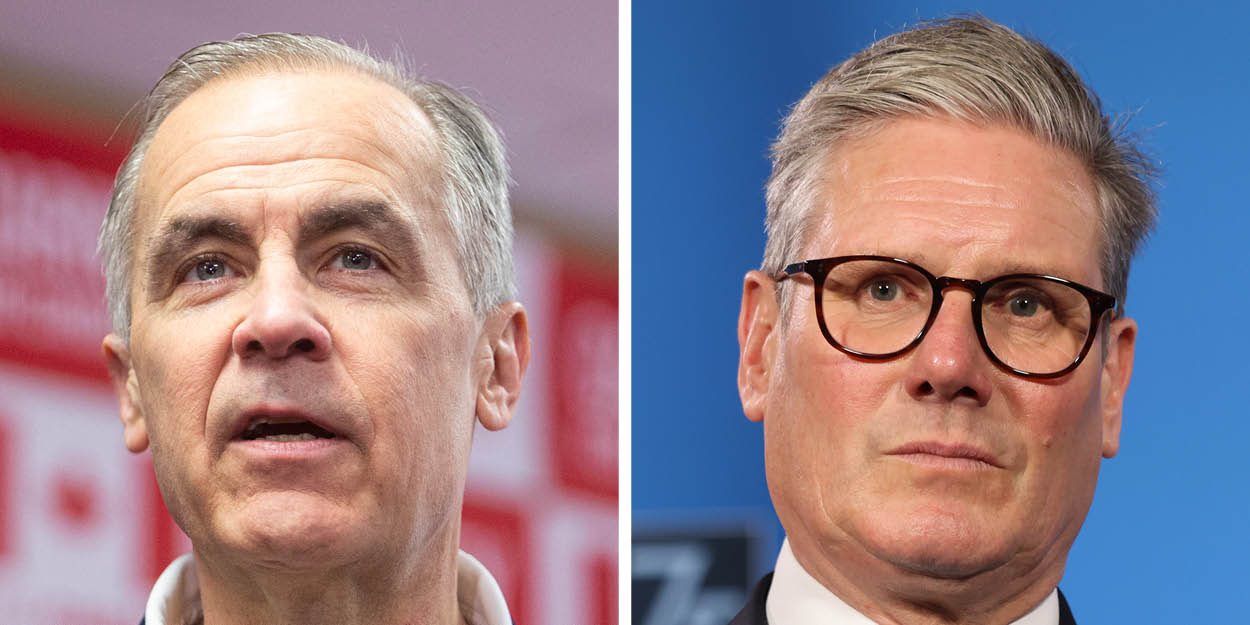

Prime Minister Mark Carney has made it clear from the start that his priorities are investment and growth. Canada has been underperforming for some time. But now this must be investment and growth in a world turned upside down by Trump. It means radical change, not tweaking at the margins.

“We will need to dramatically reduce our reliance on the United States. We will need to pivot our trade relationships elsewhere. And we will need to do things previously thought impossible at speeds we haven’t seen in generations,” Carney said. We must achieve “strategic economic autonomy.”

What does this mean? “We will need to ensure that Canada can succeed in a drastically different world. The old relationship we had with the U.S. based on deepening integration of our economies and tight security and military co-operation is over,” Carney said. But how? He warns this will take time. “There is no silver bullet. There is no quick fix.”

This is a message that calls for bold ideas—and actionable implementation. There has to be a plan. Yet despite his call for sweeping change and new ideas and policies, Carney has so far failed to tell Canadians how he would create a new economy for a country that seeks to be prosperous and sovereign.

We need to see a plan.

One key goal of such a plan has to include initiatives to grow Canadian companies that have the high value-added products and services they can profitably sell to the rest of the world. This is critical to generate good jobs and the wealth to sustain and improve vital public services such as education, health care, national security, and infrastructure.

Without these successful firms, we won’t get the jobs and wealth we need for the future. We have to change the recurring Canadian pattern: we create many young businesses with high-value products and services, with ownership of their own intellectual property giving them the freedom to operate.

But because of our financial system’s failings, weak public-sector procurement, and tax policies unsuited for the age of intellectual property and data, for example, we don’t scale up the best of these companies into world-scale enterprises. Instead, too many end up being sold to American and other foreign multinationals who go on to realize the potential of these enterprises. We create seed corn for others. This has to change. Our ambitious entrepreneurs are our future, but they need support.

This is where Carney’s own experience can be helpful. The government of Keir Starmer in Britain is pursuing an ambitious industrial strategy, underling that the government’s top priority is economic growth. To achieve higher growth, Starmer’s government has created what it calls a National Wealth Fund with almost $50-billion in capital to mobilize private investment with public-sector finance to build infrastructure and invest in patient capital—money a small or medium-sized private business raises—needed by businesses in eight high-priority sectors for a more competitive, high-value economy.

The National Wealth Fund’s mandate is to support the government’s growth agenda, including developing innovative finance solutions, operating at arm’s length from government. Last month, the British government published a directive setting out the fund’s role and how it should operate. The goal is to partner with the private sector, including pension plans, with the goal of making $1 of investment for every $3 from the private sector. It is also expected, over time, to deliver a positive financial return, covering at a minimum the government’s cost of borrowing, plus overhead.

Carney played a role in the establishment of Britain’s wealth fund: As a private citizen, he was a member of the task force that advised the Starmer government on the design of the fund. It reported with its recommendations in May 2024. So it shouldn’t have been a big surprise that after Carney had joined Brookfield Asset Management to learn that, last September, Brookfield was engaged in talks with Canada’s leading pension funds to create a similar $50-billion wealth fund in this country.

At the time, the idea was quickly dismissed by the Conservatives, and used as an opportunity to disparage Carney and to suggest ulterior motives. “Brookfield’s 2023 financial report shows that Carney holds $1-million in stock options in their firm,” the Conservatives said. “If Trudeau were to grant Brookfield’s request, how much would Mark Carney stand to personally profit?”

Yet, the idea has much merit and deserves further investigation. We need to find a way to link private funds—including pension funds—with government funds to accelerate infrastructure development in Canada, and to act as a source of long-term patient equity to support the scaling up of our best young companies into global champions. Britain was able to follow thorough quickly in creating its own National Wealth Fund by taking an existing public entity, its infrastructure bank, and adding new activities, such as equity funding for strategic business sectors. We could do the same in Canada.

There are other ways to use tax incentives and public capital to build up Canadian firms and fund infrastructure—the funds needed are beyond the existing capacity of governments alone. As stock market guru David Rosenberg has suggested, we could tap the savings of Canadians by issuing some kind of Canada growth bond, modelled on the one-time and successful Canada Savings Bond campaigns. We could extend so-called flow-through shares to strategic sectors to help young companies raise capital, adopt a program like the U.S.’s Small Business Innovation Research initiative to help young enterprises develop new technologies, have mission-oriented large-scale projects to develop and demonstrate new solutions to major problems.

There’s much we could—and must—do to successfully make what is an urgent need in response to Trump’s economic war. But we need a plan—so where is it?

David Crane can be reached at crane@interlog.com.

The Hill Times

LICENSING

LICENSING PODCAST

PODCAST ALERTS

ALERTS